Ensuring that the Fund can continue to pay benefits over the long-term, even during challenging times, is of primary importance to the Pension Board, clients and wider stakeholders. Through careful management of its solvency since its inception, the Fund is financially strong. Participants and beneficiaries can be assured that their UNJSPF benefits are secure.

The Fund’s ability to pay benefits is monitored through regular actuarial valuations (every two years) and asset liability management (ALM) studies (every four years). These studies consider alternative scenarios of increasing and decreasing numbers of participants, and high and low investment returns. This allows the Board to assess the risk associated with these and other variables.

Even in the stressed hypothetical situation of all participants separating immediately, recent actuarial valuations have shown that the Fund would be able to fulfill its obligations to pay client benefits.

The following sections provide further detail on the Fund’s actuarial valuations and ALM studies as part of its ongoing solvency monitoring.

The actuarial valuation considers the Fund from different perspectives, including:

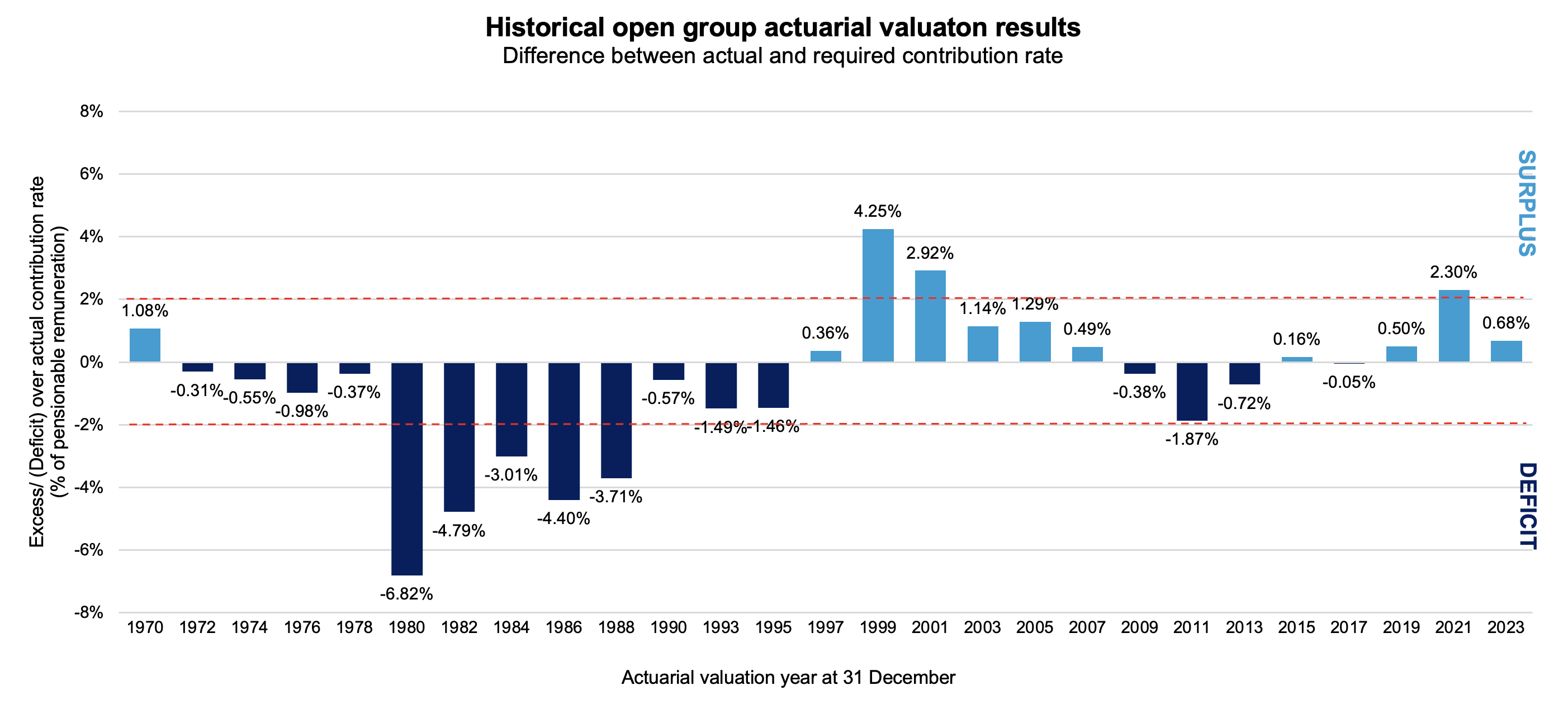

- Open group valuation: Assumes the Fund continues indefinitely with new participants joining. The key metric from this valuation is the required contribution rate, which is the theoretical contribution rate that maintains a balance between liabilities and assets over the long term. This is the primary measure for the overall health of the Fund in remaining open to existing and new participants.

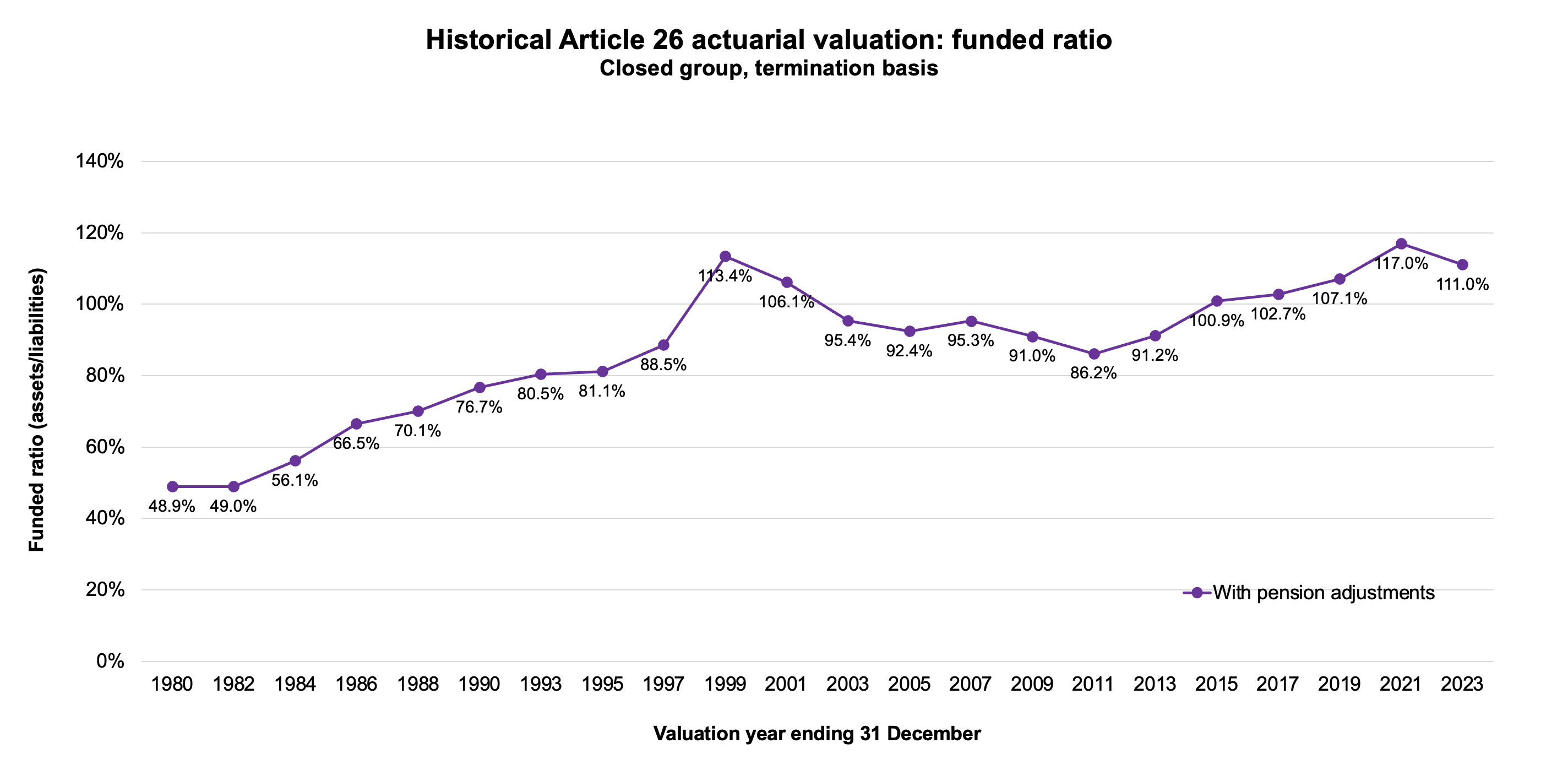

- Closed group, termination basis valuation: Assumes that all participants separate immediately. This is a valuation that is required to fulfill Article 26 of Fund’s Regulations. The key metric from this valuation is the funded ratio. This provides a view of the Fund’s ability to meet its obligations if all participants were to separate from their respective UNJSPF Member Organizations on the date of the valuation (31 December).

With liabilities extending over an average of 40 years into the future, the actuarial valuation takes a long-term view of the Fund’s assets. Short-term market fluctuations in assets are smoothed. This minimizes the risk of the long-term assessment being distorted by short-term capital market movements (both up and down) that should not impact the Fund’s ability to meet its obligations.

Recent actuarial valuation results

Open group valuation: The 2023 actuarial valuation resulted in a required contribution rate of 23.02% of pensionable remuneration to fund the pension plan adequately, which equated to an actuarial surplus of 0.68% of pensionable remuneration. The following graphic shows historical results and how the Fund has sought to maintain its surplus/deficit within +/- 2% around the current contribution rate of 23.7% of pensionable remuneration.

Closed group valuation: The 2023 valuation resulted in a closed book valuation of accrued benefit liabilities of US$83,151.2 million, as compared with an actuarial value of assets of US$92,322.9 million. This equates to a funded ratio of 111.0%, with the historical funded ratios summarized below. This means that if all participants were to separate immediately, the Fund should be able to comfortably pay all future expected benefits.